On 23/7/2024 FM presented the union budget for the FY23-24.Here are the key points to takeover and highlights’ of the budget.

Read more to understand the key points.

Taxation Updates(- impact the stock market)

• Limit of exemption at capital gains proposed at Rs 1.25 lakh a year

• STT on F&O hiked to 0.02% and 0.1%

• Corporate tax rate on foreign companies reduced to 25%

• Limit of LTCG hiked from 10% to 12.5%

• Short term gains on certain financial assets will be 20 percent, rest is applicable tax rate

• Long term capital gains will be 12.5 percent

• Listed financial assets held for more than a year will be classified as long term

• TDS rate on e-commerce operators to be reduced to 0.1 percent from 1 percent

• Tax rate of 20 per cent on certain assets. Rest to attract applicable rates

• Listed financial assets held for more than a year will be classified as long term

• Unlisted bonds and debentures, irrespective of holding period, to attract CGT as pwer applicable rates

Impact on Direct tax payers

- Abolishment of Angel Tax announced for all classes of investors

• Professionals in MNCs who get ESOPS and then invest in movable assets abroad of up to Rs 20 lakh decriminalized / non-penalized

• Under new tax regime, standard deduction hiked to Rs 75,000 from Rs 50,000

• Deduction on family pension for pensioners to be enhanced to 25K Rs

• Salaried employee will save Rs 17,500 in income tax

New tax regime Tax rate structure to be revised as follows:

• 0-3L — 0%

• 3-7 L — 5%

• 7-10 L — 10 %

• 10 – 12 L — 15 %

• 12 – 15 L — 20%

• over 15 L — 30%

IMPACT ON PARTICULAR SECTOR-

- POSITIVE FOR SOLAR PANEL ASSEMBLERS Solar energy: Expand the list of exempted capital goods used in mfg. of solar cells, panels.

- ADDITIONAL 30M HOUSES FOR AFFORDABLE HOUSING SCHEME.Additional 30m Houses For Affordable Housing Scheme.

- Grants For Backward Regions Of AP TO Be Provided As Per AP Reorganization Act Concerted Efforts Made To Fulfill Commitments Under AP Reorganization Act

- To Announce Credit Guarantee Scheme For MSME In Mfg. Sector andTo Bring MSME Credit Guarantee Scheme For Collateral-Free Loan.

- PSU Bank will built Their Own in house capability To Access MSME for Credit Instead of relying on external assessment.

- Rs 2.66t To Be Provided For Rural Development.

- Enhanced Mudra Loan Limit To 20 Lakhs From 10 lakh(for TARUN category).

- Credit Support To Small And Medium Businesses During Stress Period.

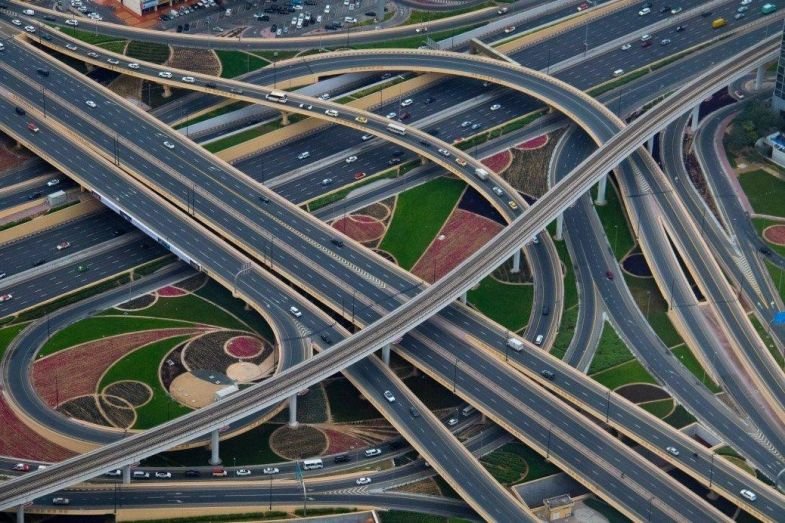

Development of infrastructure.

- SIDBI Branches In MSME Clusters To Be Expanded In Next 3 Yrs To Provide Direct Credit E-Commerce Hubs Will Help Facilitate Trade & Export Related Services Under One Roof.

- Internship Allowance Of ₹5,000/Month & 1-time Assistance Of ₹6,000 To Be Given.

- TO ALLOCATE 10TRLN RUPEES FOR URBAN HOUSING.

- Free electricity program via solar panels was announced for 100,000 households.PM Surya Ghar Free Electricity Scheme for 1 Cr House.

- Govt to partner with private sector for Bharat Small Reactors for harnessing nuclear energy.

- This year , 11.11 Lakhs Cr For capex , That’s 3.4 % Of GDP

- India Plans 800mw Ultra Super Critical Thermal Power Plant.

Leave a Reply

Want to join the discussion?Feel free to contribute!